costa rica taxes for canadian expats

Our events cover various interests and range from a small expat dinner to enjoy the traditional Costa Rican cassado to big expat get-togethers with hundreds of guests in San Josés top locations. As a result we have been receiving a number of questions from expats living in Costa Rica regarding the countrys tax system social security benefits how to minimize a US expat taxes and whether or not we are able to provide US expatriate tax services to American expats.

Moving To Costa Rica A Guide For Expats To Live Here

What you pay is based on the income you used to qualify for residency typically 75 to 100 per month for a retired expat couple.

. It is important to understand that these programs only provide temporary residency. Furthermore there is no capital gains tax and annual. Need to file your taxes.

Corporations that earn between 51 million and 119 million have to pay 30 of minimum wage yearly 127500. Here is the list of the best places to live in Costa Rica. Our clients hail from all parts of the country - San Josà and Puerto Limón.

Property Transfer Tax When property is purchased in Costa Rica it must be transferred into the buyers name. As the Hong Kong protests against Chinas extradition bill continue China watchers in Canada are predicting an expat exodus. According to a 2018 survey by International Living a single expat can get by on an income of 1600 per month.

There are 2 different types of income taxes in Costa Rica. Citizens and green card holders working in Costa Rica for over 6 years. For the self-employed the rates range from 10 to 25.

Unbeknownst to most American expats they have another problem IRS Form 5471. In Costa Rica income tax rates are progressive. Costa Rica requires at least 1000 in monthly income from sources such as Social Security or pensions in order to qualify for residency.

The warm climate and cost of living is compelling a growing number of Americans to move to Costa Rica. This involves a property transfer tax. Any individual employed in Costa Rica pays a monthly withholding tax rate based on his salary.

Income taxes on individuals in Costa Rica are levied on local income irrespective of nationality and resident status. Employment income on a monthly basis of individuals is subject to a tax of up to 15. Some retired couples are able to live comfortably including healthcare and transportation for about 2500 per month.

Although not very big the country is diverse so which regions should you choose to settle in and why. Costa Rica Taxes For Canadian Expats. Costa Rica income tax rates are progressive between 0-25.

Income tax on wages and income tax on profit generating activities. Costa Rica staff More Canadians expats have become the latest target of US. Only the investor is eligible and not their family members.

Once you have lived in Costa Rica for three years you will be able to obtain permanent residency. You may also join one of our expat excursions. Liisa is a Canadian expat living in Costa Rica.

Additionally you are cordially invited to participate in our regular expat events and activities taking place in Costa Rica. Many of my friends and their families here in Costa Rica have arrived in different ways and for different reason. The maximum tax rate of 15 percent for employment income and 25 for self-employment and business income.

For individuals domiciled in Costa Rica any income obtained within the boundaries of Costa Rica is considered as Costa Rican-source income and is taxable. At Taxes for Expats we have been preparing US. However there is a luxury tax levied against properties worth 250000 or.

To illustrate if you buy a property worth 150000 your annual property tax will be just 375. Table of Contents The Central Valley San Jose Escazu Santa Ana The Pacific Coast. The panic continues for those with a company association trust or other legal entity in Costa Rica that is required to file a shareholders and beneficial owners report with the Central Bank as mandated by Law 9416.

Property transfer tax in Costa Rica. I get asked almost daily by tourists I meet here how I live the life I do. Is reporting that 900000 copies of Canadian expats citizens bank records have been shared with the US.

Growing up I always enjoyed the outdoors and activities like mountain biking snowboarding skiing snowmobiling dirt biking hunting and fishing the. This program allows individuals to make a 200000 Costa Rican investment. Property tax in Costa Rica is one of the lowest in the world it is 025 of the registered value per year.

Canadian pundits expect expat exodus from Hong Kong. Income subject to tax in this country includes employment income self-employment business income investment income directors fees and capital gains. Exclusive to AM.

Every individual employed in Costa Rica must pay a monthly withholding tax that is based on hisher salary. The annual property tax in Costa Rica is assessed at a fixed rate of 025 of the propertys value per year. Tax returns for US.

Meet Jason Canadian Expat in Costa Rica. Latest News Relating to Costa Rica or Canada. Corporation Tax Rates in Costa Rica.

Which countries does Canada have tax treaties with. US Expat Taxes - Costa Rica. Last reviewed - 03 February 2022.

Applying as a Inversionista. Active corporations that earn up to 51 million have to pay 25 of minimum wage yearly 106250. I grew up in a small town of central British Columbia Canada named Williams Lake.

5 Tips For Canadian Retirees Moving To Costa Rica Costa Rica Mls Property transfer tax in costa rica Costa rica taxes for canadian expats. The main draw of costa ricas tax system is the principle of territoriality. Non-active corporations have to pay 15 of minimum wage yearly 63750.

Tell us a little bit about you and what made you move to Costa Rica. At the present time. The Canadian Broadcasting Corp.

Costa Rica is very popular with expats especially from the USA as an affordable retirement destination.

5 Tips For Canadian Retirees Moving To Costa Rica Costa Rica Mls

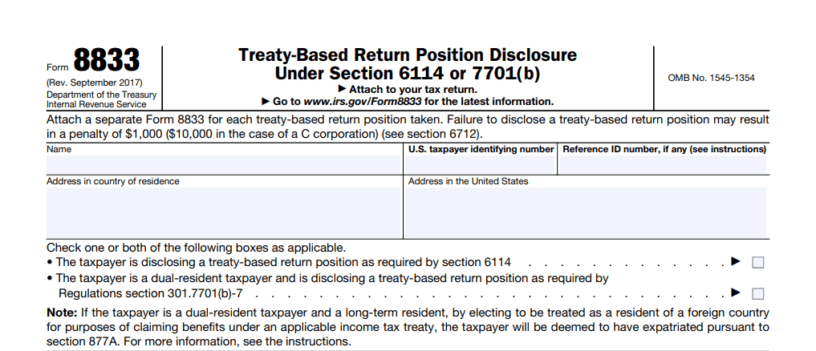

Form 8833 Tax Treaties Understanding Your Us Tax Return

Country Of The Month Costa Rica Advisor S Edge

5 Tips For Canadian Retirees Moving To Costa Rica Costa Rica Mls

Canadian Expats In Costa Rica Hope To Regain Right To Vote

A Us Citizen Living In Canada Taxes Filed As An Expat

Irs Amnesty Programs For Late Filers Expat Tax Professionals

Costa Rican Taxes For U S Expats 8 Things To Know About Tax Returns

6 Reasons Why Canadians Love Costa Rica

Join The Biggest Expat Community For Canadians In Costa Rica

Can Canadian Home Buyers Purchase Property In Costa Rica

5 Tips For Canadian Retirees Moving To Costa Rica Costa Rica Mls

Do Canadian Expats Have To Pay Tax On Income Earned Outside The Country

Costa Rica Or Panama Which Is A Better Choice For You

Does Costa Rica Have A Tax Treaty With Canada Cubetoronto Com

How Is Rental Income Taxed In Costa Rica Costaricalaw Com

5 Tips For Canadian Retirees Moving To Costa Rica Costa Rica Mls